Municipalities see jump in potash tax sharing distribution

November 3, 2025, 1:56 pm

Nicole Taylor, Local Journalism Initiative Reporter

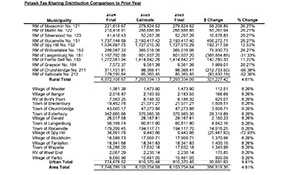

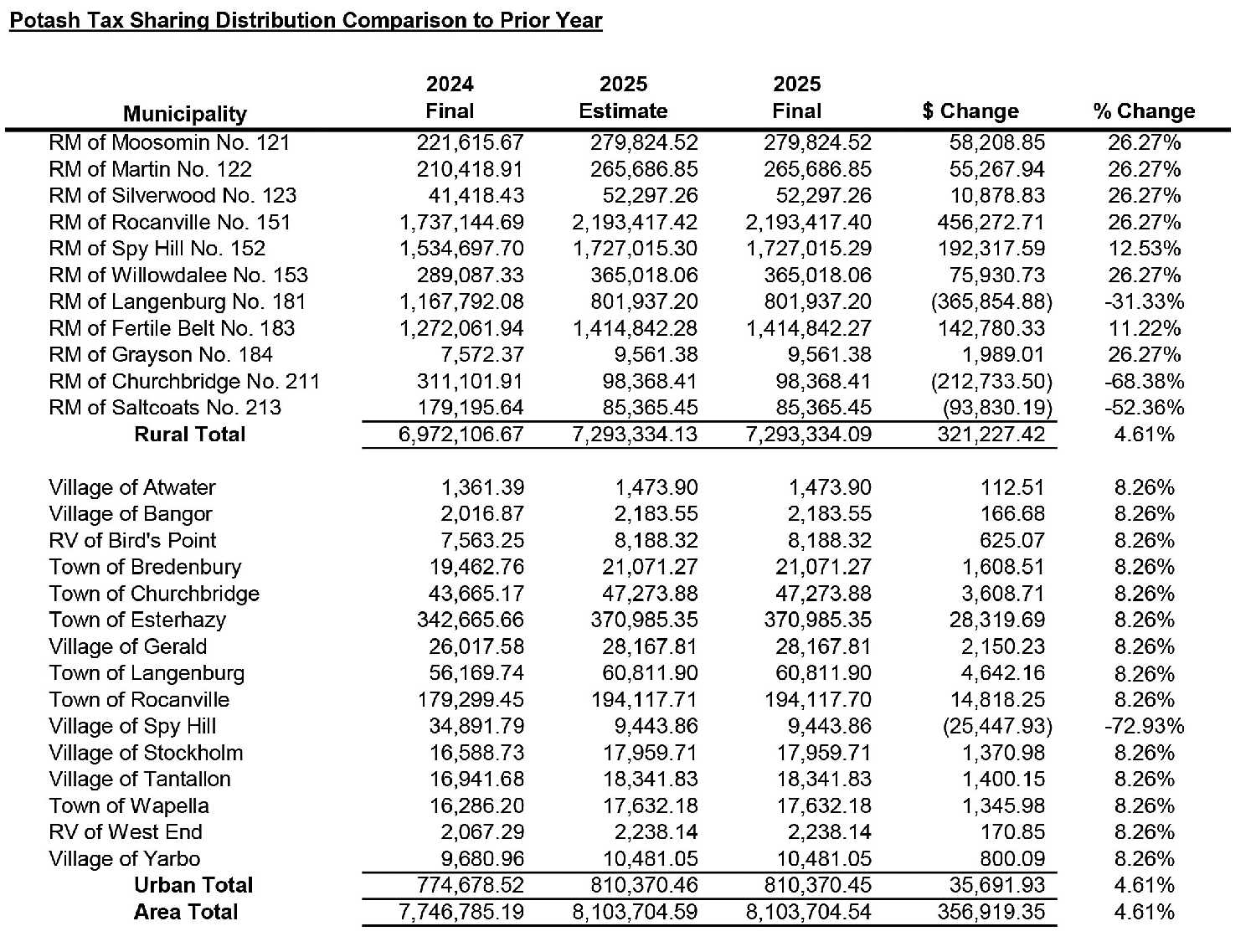

Most municipalities in the Esterhazy-Rocanville area of influence saw a significant jump in potash tax sharing distribution in 2025, with the majority of RMs seeing a 26.27 per cent increase from 2024, and the majority of towns and villages seeing a 8.26 per cent increase from 2024.

The 2025 final potash tax sharing distribution numbers were shared with municipalities in October.

The town of Esterhazy will receive $370,985.35 in 2025, up $28,319.69 from 2024. The town of Rocanville will receive $194,117.70 in 2025, up $14,818.25 from 2024.

Most urban municipalities are seeing a jump of 8.26 per cent with the exception of the village of Spy Hill, which saw a reduction of 72.93 per cent, or a decrease of $25,447.93 from 2024.

In the RMs, the RM of Rocanville has received the most in potash tax sharing distribution. This year the RM is receiving $2,193,417.40, an increase of $456,272.71 from 2024 or 26.27 per cent.

The RM of Spy Hill will receive $1,727,015.29, an increase of 12.53 per cent and $192,317.59 from 2024. The RM of Fertile Belt will receive $1,414,842.27, an increase of $142,780.33 from 2024 or 11.22 per cent.

The RMs of Moosomin and Martin both received a 26.27 per cent increase.

Some RMs, such as Langenburg, Churchbridge and Saltcoats are seeing significant decreases in the amount they receive.

The World-Spectator interviewed Doug Fisher of Special Projects with the Saskatchewan Association of Rural Municipalities in May of 2024. At the time Fisher said these changes were to be expected.

“The reason for the change is that right now, potash tax sharing is calculated based on what’s called an overlapping area of influence,” he said.

He pointed to the Esterhazy Area as an example with K1, K2, and K3 Mosaic mines, Nutrien Rocanville and Nutrien Scissors Creek being used to calculate the annual assessment.

“Right now, the calculations are done based on an area that’s taking all those mines into consideration,” Fisher said. “Starting in 2026, each individual mine will have its own area of influence. So the taxes for that mine will only be distributed to the municipalities within its area of influence. So that’s the change that they introduced in 2021 to be effective in 2026.”

An area of influence is defined as being 32.2 km from the centre of the section where a mine is located.

It makes a difference

Municipalities that are seeing an increase say it makes a big difference for them.

“It absolutely helps, especially with the increase in costs of everything in town,” says Esterhazy mayor Randy Bot. “When it comes to infrastructure, having that extra money in our account that we can take off the burden of the ratepayers—it’s great for our municipality.

“At the moment it’s not earmarked for anything specific. I’m guessing that it will go towards the water treatment plant, just because we will be in the final stages of that project, but it will just probably go into the account for budget and we’ll use it for infrastructure upgrades in the upcoming year.”

“That is just under $200,000 that is not required from our ratepayers,” adds Rocanville Administrator Tanya Strandlund. “I can only imagine the increase in taxes it would take to subsidize that funding, it’s so appreciated and helpful.

“It’s usually earmarked for paving, but because of the increase we are not sure what the difference will be used for. I know at one point it was announced that we would be using the difference toward pool payments so that we didn’t have to increase the taxes for pool repayment. But with the recent changes to the pool funding, I’m not sure what it’s going to be earmarked for, but that’s usually what it is for is paving and pool payments.”

She says it’s her understanding that the town will be receiving an increase again in 2026.

“The idea is still that next year we will also see another increase. That’s the way I understand the conversation from a year ago, that in 2026 the increase will be even higher. They did a slow change so that the communities being affected by the reduction in funding had some time to adjust to it and make a plan.”

“It’s great for the RM. It’s going to enable us to do some of those big road building projects that always cost a lot of money,” said RM of Rocanville Reeve Melissa Ruhland. “And with the mine we have a lot of traffic on our roads. Our west grid sees between 375 and 400 vehicles a day. It’s hard to maintain those roads, so being able to do some road building and having the man power to keep them maintained helps.

“We have great employees at the RM. When you are in this area you have to compete a little bit with wages too, so that enables us to hire a good workforce for doing all that work.

“And the RM contributes to money to some of the big projects in the area, like the airport, which was a big chunk of money, and for our local pool, we gave $300,000. If we didn’t have the potash tax sharing, that wouldn’t be able to happen because it would be going all to your costs of running your RM.

“So we are able to help out the local community because of it as well.”